Nesec has been active as a financing institution for the maritime sector since 1946. We are continuously seeking sustainable financing solutions for our clients.

The Netherlands will continue to play an important role in maritime transport in the future, particularly in short sea shipping. Reducing CO2 emissions, and developing alternative energy sources are continuous challenges. Tansport by ship remains the most efficient and the cleanest mode of transport. Credit capacity for the financing of SMEs in the shortsea sectoris limited.

Our goal is to make a difference in our industry. Nesec develops, in addition to traditional methods of financing, various debt funds for diverse target groups and capital goods, of which the Nesec Shipping Debt Fund (NSDF) is the most well-known. NSDF is a €250 million that provides first priority mortgage loans with a focus on short sea shipping. Read more about NSDF here.

Currently, work is underway on the new Maritime Emission Reduction Fund. With this fund, we will finance a sustainable, vibrant, and profitable maritime sector. For more information on the opportunities to participate in one of our funds or to be kept informed about new funds, click here.

Nesec proudly presents its latest fund, the Maritime Emission Reduction Fund (MERF). This €200 million fund will focus on financing sustainable solutions for existing ships and financing sustainable new ships. The funding for the ships will be used to reduce emissions below future emission standards. This enables shipowners to benefit from the (financial) advantages of an environmentally friendly ship. MERF will be used for the sustainable development goals outlined below, globally known as the United Nations Sustainability Development Goals. The fund closing is expected to take place in 2026. Afterward, we expect to be able to issue the first loans.

The Nesec Shipping Debt Fund (NSDF) is a €250 million financing fund aimed at sustainably addressing bottlenecks in maritime financing capacity. NSDF is designed to stimulate the shipping industry, with a focus on supporting the short sea shipping sector and the surrounding maritime cluster. Through the fund, first mortgage loans are provided to boost investment in both newbuild and second-hand vessels. Short sea shipping represents a vital segment of the Dutch maritime industry. The fund maintains a diversified portfolio of ship loans and has received approval from the European Union, the Dutch government, and a credit risk rating from an independent agency.

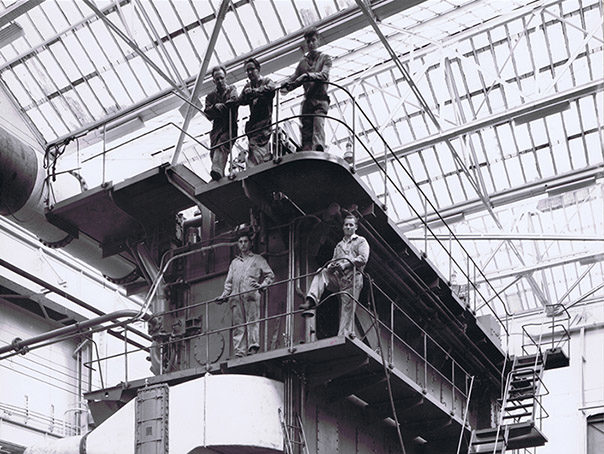

Nesec is founded by 6 shipbuilders.

Delivery of the first series of 8 tugs to Poland.

Start direct lending to shipowners.

Tumultuous growth of shipping and shipbuilding.

Winschoterdiep expands to 16 metres, wider ships are being built, indoor building becomes a common practice.

Besides exportfinance for foreign shipowners, Dutch shipowners are provided with loans.

Nesec takes on external funding.

Nesec aims at financing instead of export.

Separation finance activities and idealistic goal.

Nesec is accredited in accordance with Growth facility of ministry of Economic affairs.

Issuance Nesec bonds.

Provision of mortgage backed loans with guarantee from the ministry of Economic affairs for funding of institutional investors.

A special milestone, our 75th anniversary! In honor of our 75th anniversary we will use our special anniversary logo this year.

Projected MERF launch

* Nesec will only use your personal information to be able to communicate with you. This information will never be transferred to third parties. Read more about this subject in our privacy policy.

Wil jij de boot niet missen? Kom dan ons Maritiem financiële team versterken!

Omschrijving

Voor een periode van 3 – 6 maanden zoeken wij een medewerker die het NFM-team kan

versterken. NFM is actief in de scheepsfinancieringen in het short sea shipping segment.

Onlangs heeft NFM een fonds opgericht, waarmee eerste hypotheek financieringen op

short-sea schepen kunnen worden verstrekt.

De stagiair zal meedraaien met het dagelijkse werk, waaronder: